Why I'm a Long-Biased Trader

At some point in your trading journey, you'll hear the classic stock market axiom: 'Never be a perma-bull or perma-bear.' But I disagree. Completely.

But I disagree. Completely.

If you've been a perma-bull over the past 20 years, you're likely sitting on a downright fortune.

But the perma-bears? Those gloomy doomsayers perpetually warning of the "Mother of All Market Crashes?!"

They're still waiting for their elusive Black Swan event, cursing at the sky in their tin foil hats, missing out on some of the greatest money-making opportunities in history.

The U.S. stock market has a built-in upward bias. The benchmark index S&P 500 has delivered a 10.65% annualized return from 2005 to 2024.

Businesses grow, innovation drives productivity, and passive money continues flowing into funds, pushing the major indexes higher over time.

It's like "reversed gravity," always in the background, pulling share prices up.

Trading calls for further upside isn't blind optimism. It's betting on historical precedent. It's stacking the odds in your favor.

But there's more to it than simple market trends.

Not only do stocks naturally rise over time, but there's also a hidden asymmetry in options pricing that makes calls far better bets than most traders realize.

With that in mind, let me show you five reasons why I prefer trading calls over puts (and why you should, too)...

1. The Market Likes to Go Up

The primary reason I prefer trading calls is that they align with the market's natural trajectory.

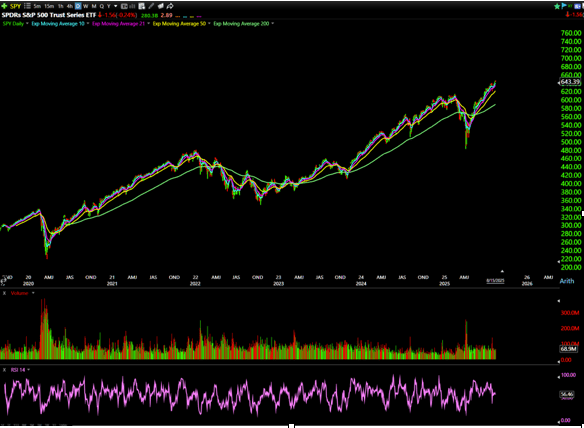

Over the past five years, the S&P 500 has delivered an annualized return of 13.3%:

SPY chart: 5 years, daily candles — courtesy of TC2000

This means call options have a statistical edge as they benefit from the market's inherent bullish slant.

But if you're regularly trading puts, you're fighting against decades of historical data.

Worse yet, you're not just betting against corporate earnings growth, Fed policy, and technological progress.

You're also up against trillions of dollars in passive inflows from ETFs, 401ks, IRAs, mutual funds, and pension funds.

The trend is your friend. And the trend is usually up.

2. Puts Trade at a Premium

Puts are systematically more expensive than calls due to higher implied volatility (IV).

Why Are Puts Priced Higher?

Downside Protection Demand: Institutional portfolio managers constantly buy puts to hedge their portfolios. This persistent demand drives up put prices.

Volatility Skew: Market crashes tend to be sharp and fast, while rallies are usually slow and steady. This leads to higher IV for out-of-the-money (OTM) puts compared to OTM calls.

Tail Risk Pricing: Traders pay a premium for "insurance" against unexpected downside events, and market makers charge extra for the risk of a sudden collapse.

How Much More Expensive Are They?

Studies show that OTM puts generally have 20-30% higher IV than comparable calls.

This means put buyers need a much larger move in the underlying stock to break even.

If the chart doesn't crash quickly, the inflated premium erodes profits.

Meanwhile, calls are priced more efficiently because:

- Stocks rise gradually, reducing the need for panic-driven call buying.

- There's less demand for calls than puts (more on this later).

This pricing quirk gives call buyers a massive edge that 95% of the market isn't even aware of.

While institutions overpay for downside protection, you can easily capitalize on relatively cheap calls that benefit from the market's natural upward drift.

3. Supply & Demand Skews Options Pricing

Options prices are heavily influenced by supply and demand.

When fear rises, traders flood into puts, driving up IV and premiums. This is why puts are often overpriced: investors are willing to pay a multiple to protect large portfolios.

But what about calls?

- Less panic-driven demand means calls don't experience the same IV spikes.

- Covered call writing (a popular income strategy) creates constant selling pressure on calls, keeping premiums in check.

This creates a structural mispricing just begging to be taken advantage of…

4. Are Calls Too Cheap?

If puts are consistently expensive due to demand, it begs the question: Are calls underpriced?

Short answer? Yes.

Here's why:

A. Market Structure Favors Gradual Upside Moves

Stocks tend to rise in a "stairs up, elevator down" pattern. Since upside moves are slower and more predictable, options models assign lower IV to calls.

B. Institutional Call Selling

Many funds sell covered calls for income, creating a constant supply (and suppressing call premiums).

C. Fear > Greed in Pricing

Investors pay more to avoid losses than to chase gains. This behavioral bias keeps put premiums elevated while calls remain relatively cheap. Supply and demand.

D. Liquidity Gaps

Because large institutions buy stocks outright (rather than speculate with calls), put liquidity is often deeper, keeping call spreads tighter and more favorable for buyers.

5. Uptrends Are Easier

Last, but most importantly … uptrends are easier to trade than downtrends or crashes.

- Upside moves tend to follow clear patterns: pullbacks, consolidations, breakouts.

- Downside moves are often violent and chaotic, making them more difficult to time and trade consistently.

While it's possible to profit from crashes, the odds of consistently catching them are peanuts.

Meanwhile, the slow, steady grind higher gives call traders more opportunities to enter and exit with a consistent process.

It's not easy to win consistently in the options market. Doing so requires trading the highest-probability positions with the best risk/reward possible.

Calls offer both of these (plus smoother trends and cheaper pricing).

So yes, I'll remain a perma-bull.

I'll keep trading calls over puts.

And so should you.

Because the history, the facts, and the math are on our side.

Be good to yourself (and be good to others),

Ben Sturgill